If you sell home & decor products or services, you’ve probably seen this problem: ads bring “leads”, but the showroom is quiet and the pipeline feels thin.

The issue is rarely traffic volume. It’s usually that lead quality isn’t defined, tracked, and fed back into optimisation. So the ad platform keeps finding more of the same low-intent people.

This is the tracking framework we use as a home & decor digital marketing agency in pj to connect campaigns to real outcomes: qualified enquiries, booked appointments, closed sales, and revenue.

- Define lead quality using clear stages, not opinions

- Track ROI by linking ads to CRM outcomes and revenue

- Use feedback loops so campaigns improve lead quality over time

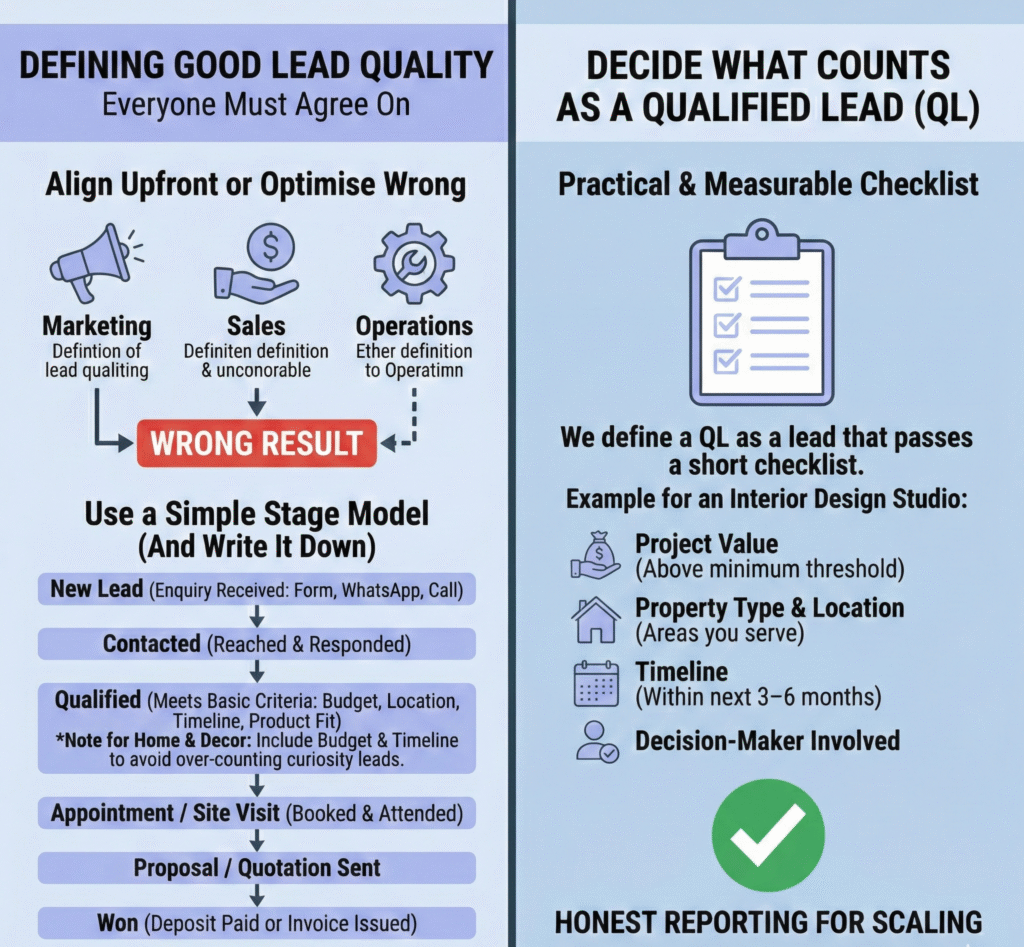

1) Start with a lead quality definition everyone agrees on

“Good lead” means different things to marketing, sales, and operations. If you don’t align upfront, you’ll optimise for the wrong result.

Use a simple stage model (and write it down)

We keep it practical and measurable. A “stage” is just a label for where the lead is in your buying process.

- New lead: enquiry received (form, WhatsApp, call)

- Contacted: your team reached them and they responded

- Qualified: meets basic criteria (budget range, location, timeline, product fit)

- Appointment / site visit: booked and attended

- Proposal / quotation sent

- Won: deposit paid or invoice issued

For home & decor, “Qualified” should include at least budget and timeline. Without those, you’ll over-count curiosity leads who like your aesthetic but can’t buy.

Decide what counts as a qualified lead (QL)

We define a QL as a lead that passes a short checklist. Example for an interior design studio:

- Project value above a minimum threshold

- Property type and location you serve

- Timeline within the next 3–6 months

- Decision-maker is involved

This is not about being picky. It’s about making your reporting honest so you can scale what actually works.

2) Track every lead back to a campaign source (even WhatsApp and calls)

Most home & decor campaigns leak tracking at the exact point where intent is highest: WhatsApp chats, phone calls, and DMs.

Use consistent source tagging (UTMs) on every ad link

UTMs are small text labels added to a URL so you can see where a lead came from (platform, campaign, ad). They’re the difference between “Meta is doing well” and “This one video ad is driving qualified site visits.”

Rule we follow: if a link can be clicked, it must have UTMs. That includes Google Business Profile links used in ads and WhatsApp click-to-chat links.

Make sure forms capture source reliably

For website forms, we pass UTM values into hidden fields so the lead record includes source data automatically. If you rely on “How did you hear about us?”, you’ll get inconsistent answers and messy reporting.

Track calls and WhatsApp properly

For calls, we use call tracking numbers where possible, or at minimum a “call lead” event plus manual source capture in the CRM. For WhatsApp, we use unique click-to-chat links per campaign so you can attribute chats to the right ad set.

Perfect attribution isn’t always possible, but consistent capture is. Consistency is what makes decisions reliable.

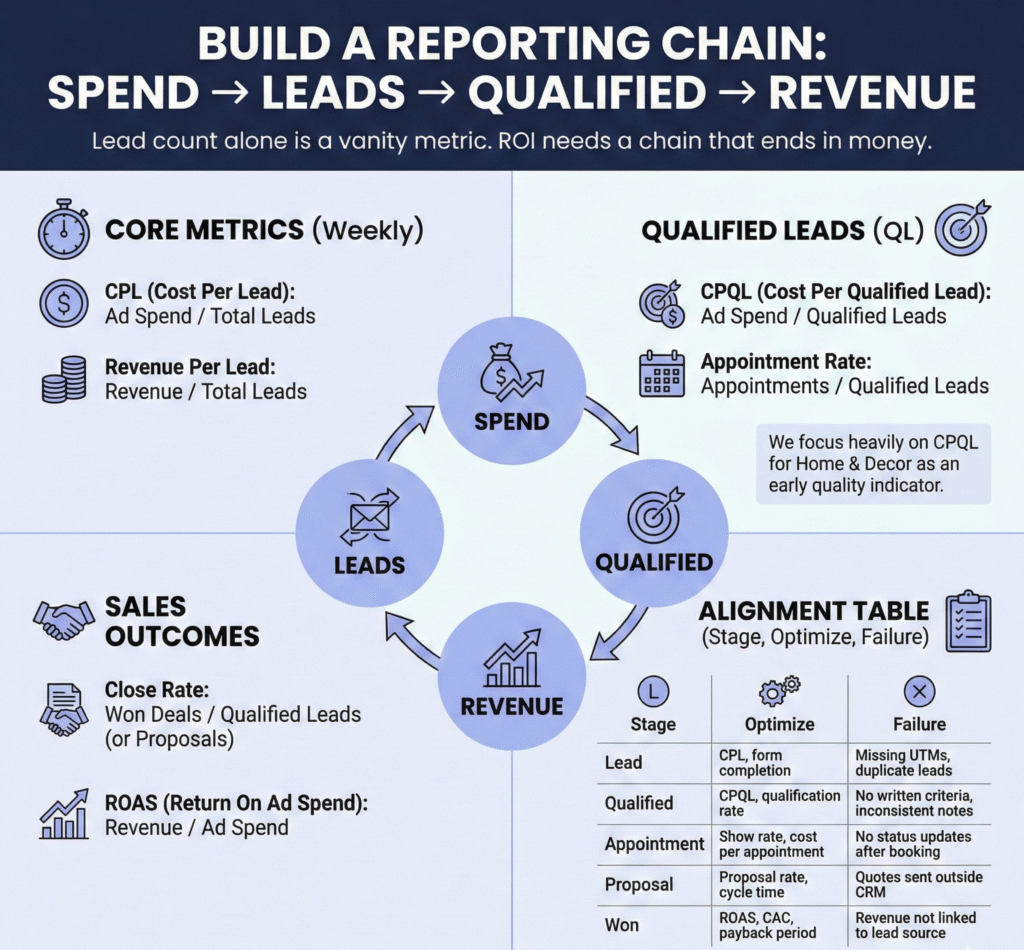

3) Build a reporting chain: Spend → Leads → Qualified → Revenue

Lead count alone is a vanity metric. ROI needs a chain that ends in money.

The core metrics we report weekly

These are the numbers that actually change decisions:

- CPL (cost per lead): ad spend divided by total leads

- CPQL (cost per qualified lead): ad spend divided by qualified leads

- Appointment rate: appointments divided by qualified leads

- Close rate: won deals divided by qualified leads (or proposals)

- Revenue per lead: revenue divided by total leads

- ROAS (return on ad spend): revenue divided by ad spend

We focus heavily on CPQL for home & decor because it’s the earliest point where quality shows up, without waiting months for a final sale.

A simple table we use to keep everyone aligned

| Stage | What it means | What we optimise | Common tracking failure |

|---|---|---|---|

| Lead | Enquiry received | CPL, form completion rate | Missing UTMs, duplicate leads |

| Qualified | Meets budget/location/timeline | CPQL, qualification rate | No written criteria, inconsistent sales notes |

| Appointment | Visit or consult booked/attended | Show rate, cost per appointment | No status updates after booking |

| Proposal | Quote sent | Proposal rate, cycle time | Quotes sent outside CRM |

| Won | Deposit paid / invoice issued | ROAS, CAC, payback period | Revenue not linked to lead source |

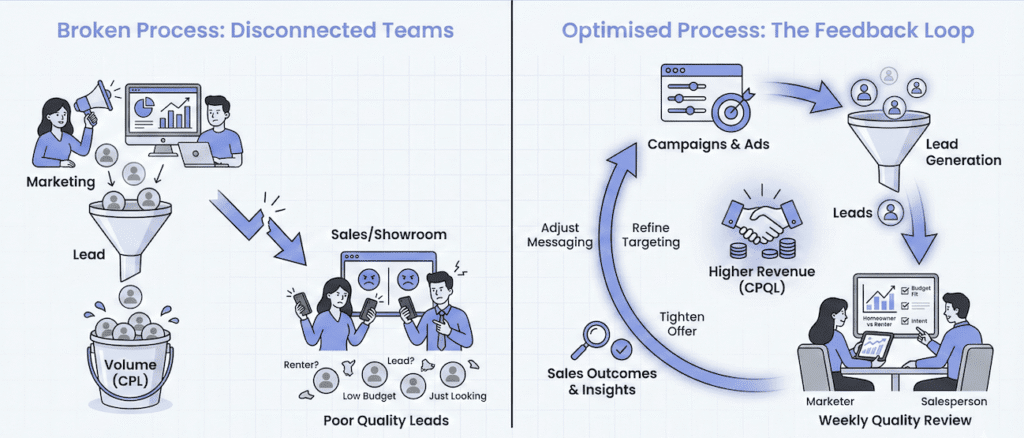

4) Set up the feedback loop that improves lead quality

Tracking is only useful if it changes what you do next. The key is feeding sales outcomes back into campaign decisions.

Weekly lead quality review (15–30 minutes)

We pull a small sample of leads from each campaign and review them with the sales or showroom team. Not to blame anyone, but to spot patterns.

Example patterns in home & decor:

- A campaign attracts renters when you only serve homeowners

- Ad creative shows “luxury” but landing page looks budget, causing distrust

- One keyword drives many calls, but most are price-checking and never qualify

Make optimisation decisions based on CPQL and downstream stages

When we see a campaign with cheap CPL but weak qualification, we don’t automatically kill it. We first try tightening intent:

- Adjust messaging to include starting price or minimum project size

- Change the offer from “Free consultation” to “Site visit booking” to filter intent

- Refine targeting around location, property type, or in-market signals

When a campaign has higher CPL but strong appointment and close rates, we often scale it because it produces real revenue.

5) Be honest about attribution limits (and still get a usable ROI number)

Home & decor buyers often research for weeks, talk to family, visit showrooms, and come back later. That means attribution (crediting a sale to a specific ad) will never be perfect.

Use “blended ROI” alongside platform ROI

Platform ROI is what Meta/Google report inside their dashboards. Blended ROI is what your business sees: total revenue influenced by marketing compared to total marketing spend.

For decision-making, we prefer:

- Short-term: CPQL and cost per appointment

- Mid-term: close rate by source

- Long-term: blended ROAS and customer acquisition cost (CAC)

This keeps you from overreacting to noisy week-to-week data while still protecting profitability.

Conclusion: Track quality first, then scale spend with confidence

If you want better ROI from home & decor campaigns, don’t start by changing creative or increasing budgets. Start by making lead quality measurable, then connect it to revenue.

Your next steps are straightforward: define qualification criteria, capture source data for every lead (including WhatsApp and calls), and report CPQL plus at least one downstream stage like appointments or proposals.

Once you can see which campaigns produce qualified conversations and closed deals, scaling becomes a business decision instead of a gamble.

Frequently Asked Questions

Cost per qualified lead (CPQL) is usually the most useful early metric because it filters out low-intent enquiries and shows whether ads are attracting buyers who fit your budget and timeline.

You track the lead source into a CRM, then update stages until “Won” with revenue recorded. ROI is calculated by comparing ad spend to the revenue from won deals tied to those sources.

This often happens when the offer is too broad, the ads attract browsers, or follow-up is slow. Tracking qualification rate and time-to-first-response helps you see whether it’s a targeting problem or a process problem.

Google is often easiest because intent is clearer, but Meta can perform well when your tracking and qualification are tight. TikTok can generate volume, but you need strong filtering and clear stage tracking to protect quality.

It depends on your sales cycle, but many brands can see stable CPQL and appointment trends within 2–4 weeks, while reliable revenue ROI often takes 6–12 weeks as deals move through proposals and closing.