If you sell home & decor, your customers rarely go from “nice sofa” to checkout in one step. They browse, save, compare, ask someone, check delivery, and only then decide.

That journey matters because your ads and website can look “fine” while your results stay flat. The issue is usually not creativity. It’s that your marketing doesn’t match how people actually search, compare, and decide.

This is a practical explainer you can use to plan campaigns (or brief a home & decor digital marketing agency in pj) around real buyer behaviour, so you get better lead quality and more predictable revenue.

- Match campaigns to the customer’s decision stage, not your product categories

- Win comparisons with proof: dimensions, delivery clarity, and real photos

- Measure what drives revenue (not clicks) so budget goes to what converts

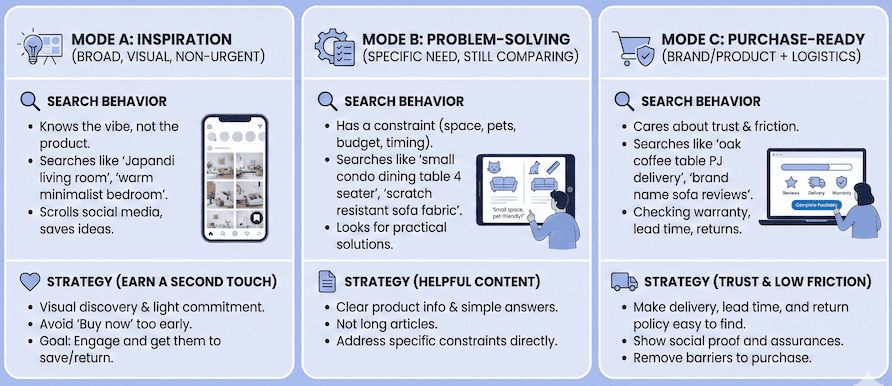

1) How home & decor customers search: the three intent modes

People search in different “modes” depending on how close they are to buying. If you run the same message to all of them, you pay more for weaker results.

Mode A: Inspiration (broad, visual, non-urgent)

This is when someone knows the vibe, not the product. They search things like “Japandi living room”, “warm minimalist bedroom”, or scroll Instagram and TikTok saving ideas.

What works here is visual discovery and light commitment. If you push “Buy now” too early, they bounce. Your job is to earn a second touch.

Mode B: Problem-solving (specific need, still comparing)

This is when they have a constraint: small space, pets, kids, rental walls, budget, delivery timing. Searches look like “small condo dining table 4 seater”, “scratch resistant sofa fabric”, “wall decor no drilling”.

This is where helpful content and clear product info win. Not long articles. Simple answers on product pages and ads.

Mode C: Purchase-ready (brand/product + logistics)

Now they care about trust and friction. Searches become “oak coffee table PJ delivery”, “brand name sofa reviews”, “same day curtain alteration”, “warranty recliner”.

If your delivery fee, lead time, and return policy are hard to find, you lose even if your product is better.

2) How they compare: what actually decides the shortlist

Home & decor comparisons are not just price. Customers are trying to reduce regret because the items are visible in their home, hard to return, and expensive to replace.

The shortlist filters most brands fail

In execution, we see the same filters come up again and again:

- Fit: exact dimensions, seat height, door clearance, lift access, room size

- Finish: colour accuracy, texture, sheen, wood grain, fabric weave

- Maintenance: stain resistance, cleaning method, removable covers

- Delivery reality: lead time, scheduling, assembly, disposal of old items

- Trust: real customer photos, warranty terms, clear returns

If your ads only show “beautiful room shots” but your product page hides fit and delivery details, you’ll get cheap clicks and weak conversion.

Why “catalog-style” ads often underperform in home & decor

Catalog ads can work, but home & decor needs context. A single product tile rarely answers “Will this look right in my space?”

Better-performing creative usually shows scale (person sitting on the sofa), texture close-ups, and a simple line like “2.1m length, condo-friendly depth, delivery in 7–10 days”.

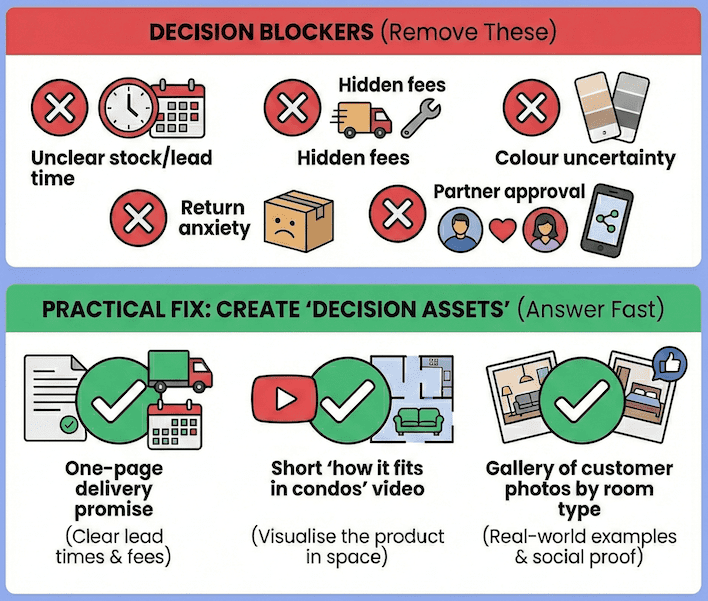

3) How they decide: the last 10% is mostly risk management

When someone is close to buying, they’re not looking for more inspiration. They’re checking for reasons to delay.

The common “decision blockers” you can remove

- Unclear stock/lead time: they don’t want to wait 8 weeks and only find out after payment

- Hidden fees: delivery, assembly, stairs, disposal

- Colour uncertainty: “Is this beige beige or grey beige?”

- Return anxiety: bulky items are painful to return

- Partner approval: they need something shareable and convincing

Practical fix: create “decision assets” that answer these fast. Examples include a one-page delivery promise, a short “how it fits in condos” video, and a gallery of customer photos by room type.

4) What this means for Meta, Google, and TikTok execution in PJ

Different platforms match different modes. The mistake is expecting one channel to do the whole journey by itself.

Google Ads: capture demand you didn’t create

Google is strongest for Mode B and C because people are already searching. Use Search campaigns for “problem-solving” keywords and “purchase-ready” keywords, and make sure the landing page answers the exact query.

In PJ, include location modifiers only when they reflect real intent (delivery area, showroom visit, installation). Otherwise you restrict volume too early.

Meta Ads (Facebook/Instagram): create the second touch

Meta is strongest for Mode A and early Mode B. You’re building familiarity so that when they later search on Google, you’re on the shortlist.

Retargeting matters here, but keep it honest. If someone viewed a dining table, show the table in a real home, plus delivery timeline and size options. Don’t just show the same glossy image again.

TikTok Ads: prove the product in 10 seconds

TikTok works when you demonstrate reality: “unboxing”, “wipe test”, “before/after”, “small room setup”. It’s less about perfection and more about trust.

If you can’t produce weekly videos, don’t force TikTok. Consistency affects performance more than one viral attempt.

5) A simple mapping: behaviour to message, channel, and KPI

Use this table to align your team (or your home & decor digital marketing agency in pj) on what success looks like at each stage.

| Customer stage | What they’re doing | What to show | Best-fit channel | Primary KPI |

|---|---|---|---|---|

| Inspiration | Saving ideas, browsing styles | Room context, style labels, “why it works” | Meta, TikTok | Engaged sessions (time on site), saves, video watch |

| Problem-solving | Checking fit, material, use case | Dimensions, material close-ups, care info, FAQs | Google Search, Meta retargeting | Add to cart, product page conversion rate |

| Purchase-ready | Comparing brands, delivery, warranty | Delivery promise, reviews, returns, financing | Google Search, branded search, retargeting | Checkout starts, purchases, cost per purchase |

| Post-purchase | Waiting, setting up, sharing | Setup guides, care tips, photo prompts | Email/WhatsApp, organic social | Repeat purchase rate, review rate |

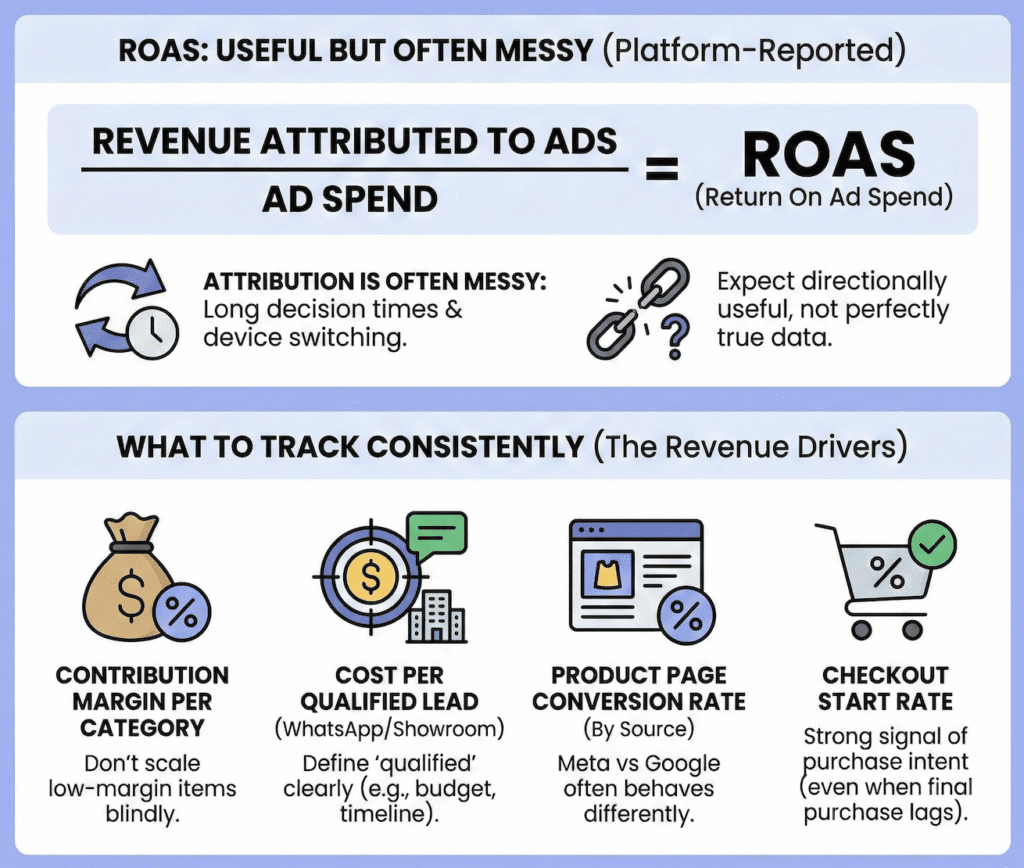

6) Measurement that reflects revenue (not just traffic)

ROAS (return on ad spend) is useful, but only if tracking is clean. ROAS simply means revenue attributed to ads divided by ad spend.

For home & decor, attribution (credit for a sale) is often messy because people take days or weeks to decide, and they switch devices. Expect platform-reported ROAS to be directionally useful, not perfectly true.

What to track consistently

- Contribution margin per category (so you don’t scale low-margin items blindly)

- Cost per qualified lead if you sell via WhatsApp/showroom (define “qualified” clearly)

- Product page conversion rate by traffic source (Meta vs Google often behaves differently)

- Checkout start rate (a strong signal of purchase intent even when final purchase lags)

If you run a showroom in PJ, track “store visit intent” separately from online purchases. Mixing them hides what’s working.

Conclusion: build marketing around how people decide, then scale

Home & decor customers don’t need louder ads. They need fewer unknowns. When your campaigns match intent mode, your site answers comparison questions, and your tracking reflects real revenue, results become more predictable.

Next steps: map your top 20 products into the table above, rewrite your landing pages to remove the top three decision blockers, and split your budget by stage (inspiration vs problem-solving vs purchase-ready). Then scale the stage that shows the strongest conversion and acceptable margin.

Frequently Asked Questions

Most use both. Social is often where they discover styles and shortlist ideas, while Google is where they confirm specifics like dimensions, price, delivery area, and reviews before they decide.

The landing page doesn’t answer comparison questions fast enough, especially dimensions, material details, delivery lead time, and return terms. People click to reduce uncertainty, not to admire photos.

It’s commonly several days to a few weeks, depending on price and delivery lead time. This is why retargeting and clear follow-up (like WhatsApp replies) often matter as much as the first ad click.

Ask them to separate campaigns by customer stage, define one primary KPI per stage, and show how tracking will connect spend to purchases or qualified leads. Also require creative that demonstrates scale, texture, and delivery reality, not only styled room shots.

No. Use ROAS alongside margin, lead quality, and conversion rates by stage. Platform ROAS can undercount sales when customers take longer to decide or switch devices, so you need a broader view of performance.